Much is being said about the prospects of a property tax in Oslo these days. No party wants that more than about a third of Oslo’s household should be eligilbe for the property tax. I’ll try to return to that topic shortly.

First, I’d like to share a letter that was on print in Klassekampn a few days ago. Here, I show how small the property tax is going to be compared to other fees charged for public services, even if SV were to get a majority in the city council to support our proposed tax. The parties on the left don’t simply want a property tax to get a laugh. We want it because we believe our city needs more money to provide its citizens with the services they deserve.

Here’s the letter:

This letter i, perhaps, somewhat unorthodox in its presentation. However, I believe Klassekampen’s readers will humour me. Consider the following equation:

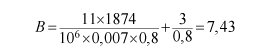

Let B be the market value of a property in millions of kroner, and solve the equation with respect to it. This gives:

Now, we can consider the significance of the other values. They are as follows:

- 0,8 – the property tax reduction factor for market values

- 3 – the proposed lower threshold for the property tax in million kroner

- 106 – calculation aid, 1 million

- 0,007 – the highest legal rate of property tax, 7 per mille

- 11 – the number of months in which afterschool is payable

- 1874 – the monthly fee for half-day service in afterschool

It should now be clear that the lowest market value on a household’s property which makes that household stand to lose more on the introduction of a property tax than it stands to gain from free afterschools is 7,43 million. I believe this equation shows that the combination of these proposals will be of economic benefit to most households in Oslo with kids in afterschool.